The global automotive and defense sectors have been shaken by China's recent decision to tighten export regulations on rare earth elements and related technologies, as the world’s leading supplier of these critical materials flexes its geopolitical muscle. Automotive industry leaders and economists warn that the expanded restrictions, now applied to a wider range of products and components, could create significant disruptions in global supply chains, particularly in Europe and the United States. The move intensifies existing tensions between China and the West, highlighting vulnerabilities in industries integral to national security and the global energy transition.

Earlier this year, China’s Ministry of Commerce began implementing export controls on rare earth minerals and magnets. Now, these restrictions have expanded considerably, affecting shipments of electric motors, computer chips, and other devices that require components made from rare earths. The new rules, set to take full effect in stages on November 8 and December 1, are aimed at preventing Chinese technologies from being used in military systems such as missiles, fighter jets, and advanced range finders.

These regulations demand that exporters provide detailed technical drawings and descriptions of how products containing rare earth materials will be utilized. The rules apply globally, even to goods containing rare earths that are merely passing through China or made using Chinese equipment or technology outside its borders.

The German Association of the Automotive Industry (VDA) has warned that China's latest export rules will have “far-reaching consequences” for Europe’s automakers and suppliers. Due to their reliance on permanent magnets and advanced electronics, many of which depend on strategically essential elements like neodymium and dysprosium, auto manufacturers face increasing uncertainty in securing critical components.

“Battery and semiconductor industries will be particularly hard hit, and thus also the automotive industry,” said a VDA spokesperson. Despite ongoing talks and efforts to expedite licensing and exports, delays have already disrupted the sector, especially since the first round of curbs was introduced in April 2025. In Italy, concerns are similarly mounting. Roberto Vavassori, chairman of the Italian auto parts lobby ANFIA, cautioned that the autumn export crackdown has drained manufacturers' rare earth reserves, leaving them vulnerable. “This buffer is no longer there,” Vavassori emphasized, suggesting that any further escalation could stall production lines.

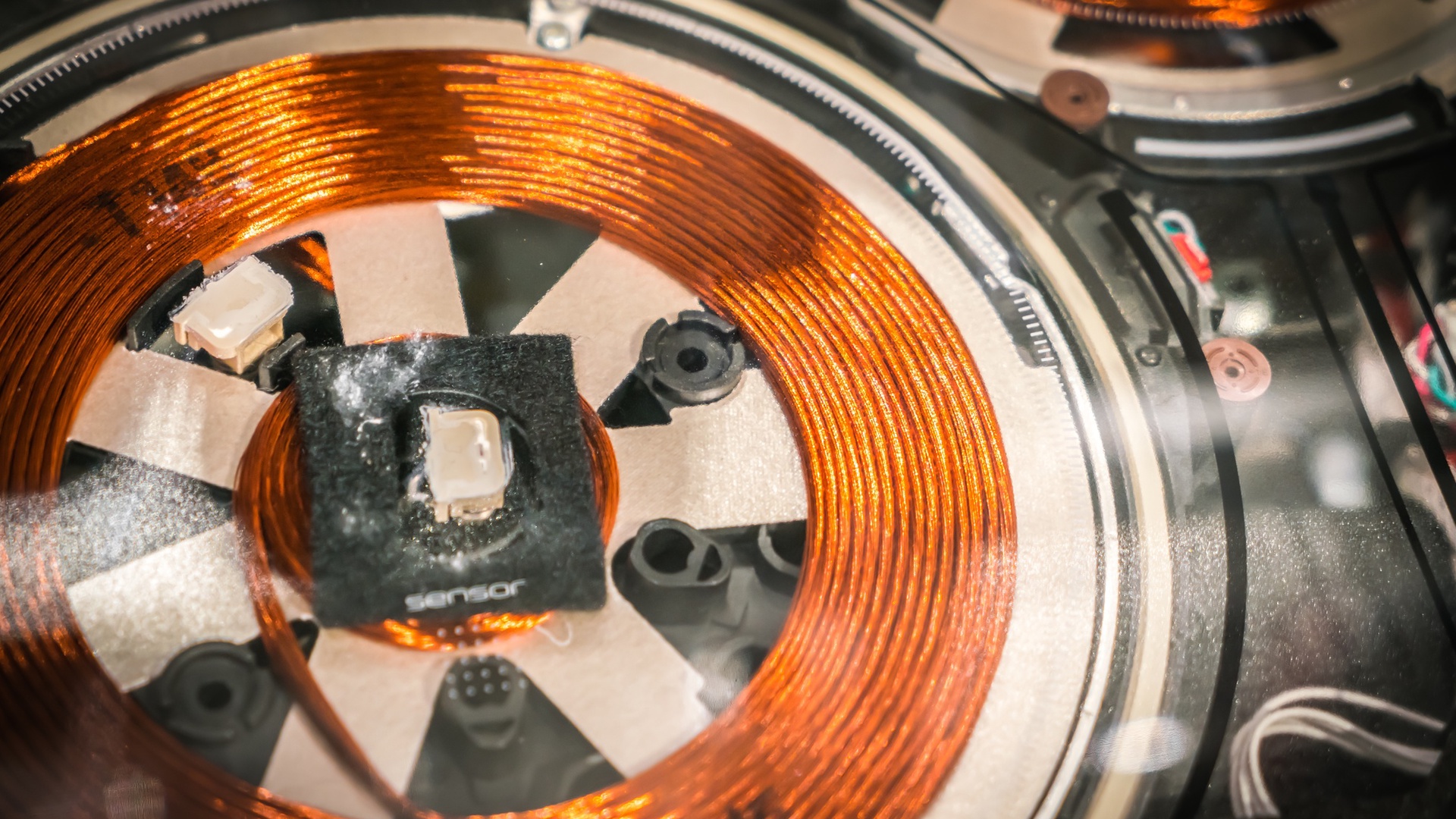

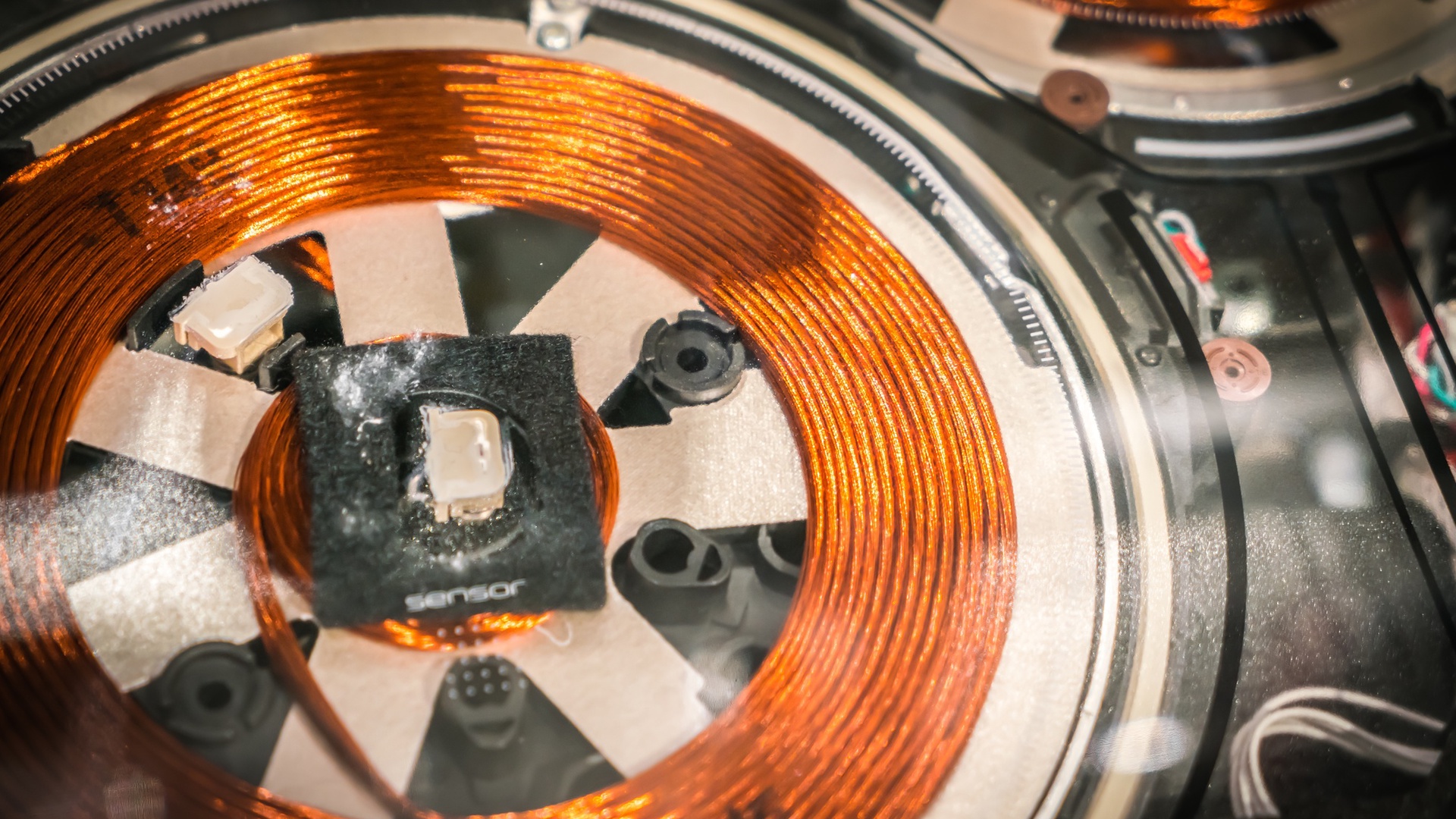

Rare earth minerals, a group of 17 chemically similar elements, are crucial for manufacturing a wide array of high-tech and green technologies. From electric vehicle motors, wind turbines, and smartphones to weapons guidance systems and radar technologies, these materials are increasingly regarded as strategic assets. A single internal combustion vehicle can contain more than 40 rare earth magnets powering systems from windows to steering; electric vehicles, which are at the heart of the clean energy transition, typically require significantly more.

As the world continues its pivot toward electrification and decarbonization, demand for rare earths is expected to soar. Yet, 60% of rare earth materials production and over 90% of the global capacity to refine them remains concentrated in China.

Western nations have long recognized the risk of overreliance on Chinese exports. Efforts to diversify and localize supply chains have accelerated in recent years, with countries like the United States, Canada, and Australia exploring new mining and refining projects. However, these alternative pathways remain years from matching China’s scale and efficiency.

Rico Luman, senior economist for transport and logistics at Dutch bank ING, points to these capacity challenges as a growing bottleneck: “China dominates 90% of global refinery capacity… Rare earths include a range of elements, some could run short in delivery.”Adding to the complexity is China’s decision to expand restrictions to include goods made with Chinese super-precision equipment or know-how, even those manufactured overseas. Many refining and magnet-making enterprises outside of China still depend on Chinese machinery inherited from decades of market dominance. The implications of China’s tightened controls extend beyond economics. The defense sector, reliant on specialized magnets for advanced military hardware, is particularly at risk. Observers in the European Union have expressed unease, especially as countries ramp up military support for Ukraine and seek to rebuild their arsenals in response to Russian aggression.

Policy experts suggest that Beijing’s strategy mirrors U.S. export controls on advanced semiconductors, indicating a broader pushback against Western containment policies. As the export battle continues to simmer, companies still reliant on Chinese rare earths face hard choices: secure costly alternatives, lobby for geopolitical resolution, or transform product designs altogether.

As governments grapple with the long-term solutions to rare earth scarcity and geo-economic dependence, businesses and consumers alike are being called upon to look inward for innovative approaches to material recovery.

That’s where companies like Phoenix Refining step in. Phoenix Refining specializes in purchasing scrap materials containing rare and critical metals, helping to close the loop in the supply chain. By recycling metals from end-of-life electronics, vehicles, and industrial equipment, Phoenix Refining helps reduce dependence on volatile international sources and supports a more resilient, sustainable materials economy. Whether you're a manufacturer seeking responsible sourcing or an individual with unused electronics, consider partnering with Phoenix Refining, a trusted leader in rare metal recycling that’s paving the way for a cleaner, more secure future.